Your local property tax system has several main components.

The property owner, whether residential or business, is responsible for paying taxes and has a reasonable expectation that the taxing process will be fairly administered. The property owner is also referred to as the taxpayer.

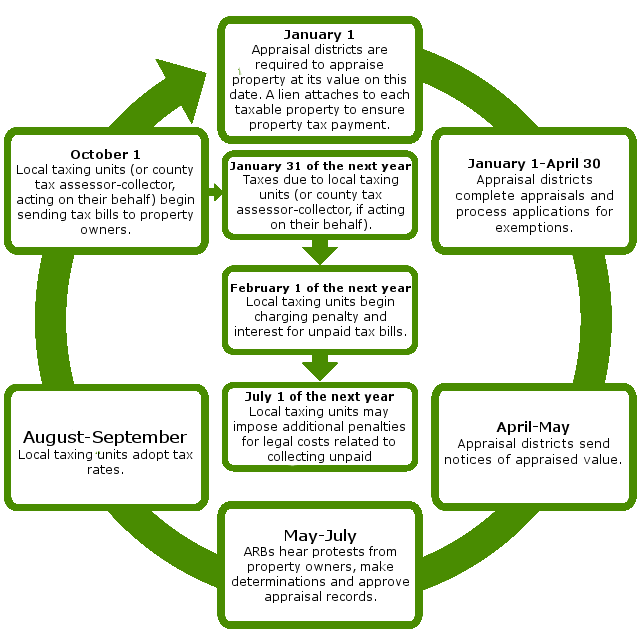

An appraisal district in each county, administered by a chief appraiser, appraises the value of your property each year. The appraisal district’s board of directors hires the chief appraiser. Local taxing units elect the board directors and fund the appraisal district based on the amount of taxes levied in each taxing unit. For more information about your local appraisal process, please contact your county’s appraisal district. The appraisal district can answer questions about exemptions and how your appraised value was estimated.

An appraisal review board (ARB) is a board of local citizens that hears disagreements between property owners and the appraisal district about the taxability and value of property. In counties with a population of 120,000 or more, members of the ARB are appointed by the local administrative district judge in the county in which the appraisal district is located. The board of directors appoints ARB members in all other counties. Protests concerning the appraised value of your property should be directed to your ARB. Your appraisal district can provide you with contact information for the ARB.

Local taxing units, including the school districts, counties, cities, junior colleges and special districts, decide how much money they must spend to provide public services. Property tax rates are set according to taxing unit budgets. Some taxing units have access to other revenue sources, such as a local sales tax. School districts must rely on the local property tax, in addition to state and federal funds.

In many counties, taxing units contract with the county tax assessor-collector to collect all property taxes due in that county. The assessor-collector then transfers the appropriate amounts to each taxing unit. Although some taxing units may contract with an appraisal district to collect their taxes, the appraisal district does not levy a property tax. For information about local taxing unit budgets and tax rates, please contact the individual school district, county, city, junior college or special district.

The role of the Comptroller’s Property Tax Assistance Division (PTAD) is primarily limited to advisory and monitoring services. PTAD conducts a biennial Property Value Study (PVS) for each school district for state funding purposes. The PVS, an independent estimate mandated by the Texas Legislature, ensures that property values within a school district are at or near market value for equitable school funding. The Comptroller’s values do not directly affect local values or property taxes, which are determined locally.

PTAD also performs Methods and Assistance Program (MAP) reviews of all appraisal districts every two years. The reviews address four issues: governance, taxpayer assistance, operating standards and appraisal standards, procedures and methodologies. PTAD reviews approximately half of all appraisal districts each year. School districts located in counties that do not receive a MAP review in a year will be subject to a PVS in that year.